Inflation is on everyone’s mind these days, especially for multifamily property owners in Rhode Island. As costs rise, finding ways to protect your bottom line becomes crucial. One strategy that’s gaining traction among property owners is implementing RUBS for Rhode Island multifamily properties. This method not only helps manage and recover utility costs but also enhances the overall value of your property, making it a robust defense against inflationary pressures.

What is RUBS?

If you’re new to the concept, a Ratio Utility Billing System (RUBS) is a straightforward yet powerful tool for dividing utility costs among tenants based on a fair and predetermined formula. Unlike installing individual meters for each unit—which can be both costly and impractical—RUBS allows you to allocate utility expenses like water, sewer, gas, electricity, and trash based on factors such as unit size or the number of occupants.

This means that instead of absorbing fluctuating utility costs yourself, this is a fair and efficient way to allocate utility costs to tenants, helping to stabilize your finances.

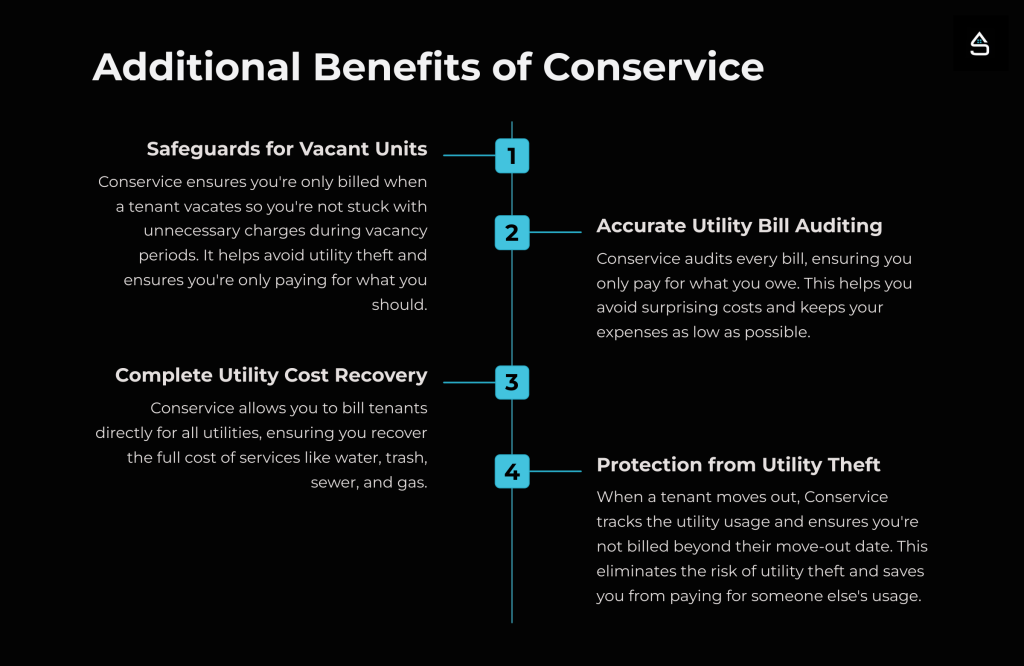

To implement RUBS, a rental property owner must partner with a utility expert company like Conservice.

Why RUBS Makes Sense for Your Property

So, why should you consider RUBS for your multifamily property? Let’s break it down:

- Cost Recovery: RUBS allows you to recover utility expenses that might otherwise eat into your profits. By fairly distributing these costs among your tenants, you can maintain a healthier cash flow and make your property more financially resilient. It’s also an effective way to adjust for price increases, unlike rent hikes, which can only happen at lease renewal.

- Boosting Property Value: Investors are always on the lookout for properties with stable and predictable expenses. By implementing RUBS, you’re showcasing a proactive approach to managing costs, which can make your property more attractive and valuable to potential buyers.

- Encouraging Conservation: When tenants are aware of their contribution to utility costs, they tend to be more conscious of their usage. This often leads to lower overall consumption, which not only benefits the environment but also reduces the property’s utility expenses.

- Scalability and Flexibility: Whether you’re managing a small building or a large complex, RUBS is flexible enough to fit your property’s unique needs. It’s a scalable solution that works for properties of all sizes, making it an ideal choice regardless of your portfolio's scope.

Additional Resources: Submetering vs Conservation

How RUBS Can Help Rhode Island Rental Property Owners Save Money?

How to Calculate RUBS

Calculating RUBS is simpler than it might seem.

The ratio occupancy method is a popular approach within RUBS for distributing utility charges in multifamily properties. This method considers the number of residents in each unit to determine a fair share of the utility costs.

In this method, a baseline ratio is calculated by dividing the total number of residents in the property by the total number of units, establishing an average number of occupants per unit. Each unit’s utility charges are then allocated based on how its occupancy compares to this average, ensuring that utility costs are distributed proportionally.

Here’s a straightforward example:

Imagine you own a 20-unit apartment building. Unit 101, a 1-bed/1-bath with one occupant, is allocated a RUBS ratio of 3.5%. If the total water bill for the entire property that month amounts to $2,000, the tenant in Unit 101 would owe $70 as their share of the cost ($2,000 x 0.035).

For Unit 202, a 2-bed/2-bath with 3 occupants, the RUBS ratio might be 6.25%. In this case, the tenants would be responsible for contributing $125 toward the bill ($2,000 x 0.0625). This system ensures that each tenant pays a fair share based on their usage and occupancy, making utility costs more manageable for you as the owner.

Real-World Success: Stonelink’s Experience with RUBS

Let’s look at how one of Stonelink Property Management’s clients reaped the benefits of RUBS. This client owns a 20-unit multifamily property in Providence, Rhode Island. Faced with rising utility costs, we recommended implementing a RUBS system. Working closely with the client, we tailored the system to their property’s specifics, distributing costs based on unit size and the number of occupants.

“Implementing RUBS with Stonelink’s guidance was a game-changer. Our property is now more profitable and appealing to investors.”- client and owner of a 20-unit multifamily

The results were impressive. Within just six months, the client saw a significant reduction in their out-of-pocket utility expenses, which led to a noticeable increase in their net operating income (NOI). Additionally, the tenants became more mindful of their utility usage, further driving down overall costs. As the client put it, “Implementing RUBS with Stonelink’s guidance was a game-changer. Our property is now more profitable and appealing to investors.”

Take Control of Your Property’s Future with Stonelink

In a time when every dollar counts, ensuring your multifamily property operates efficiently is more important than ever. A RUBS system is a smart, effective way to hedge against inflation, recover utility costs, and boost your property’s value.

At Stonelink Property Management, we’re dedicated to helping property owners like you succeed. With our deep knowledge of the Rhode Island market, we’ll tailor a RUBS system to fit your specific needs and maximize your returns.

Don’t wait for inflation to erode your profits—reach out to us today. Let’s discuss how we can help you implement a RUBS system and other strategies to protect and grow your investment.